Colombia faces a structural high unemployment rate, this high rate brings a high cost evaluated through high sensibility between GDP growth and changes on unemployment rate, this high sensibility can be pointed on a GDP growth of 3.8% if the unemployment does not show any change; and a GDP growth of 4.2% if unemployment rate declines about 1.0%, therefore Colombia government’s target is to keep growing GDP on a rate above of 3.76% if she wants to decline unemployment rate. This target will be difficult if government carries promoting FDI in crude oil and coal sector as Balance of Payments for the first semester of 2012 pointed out. On the other hand, FDI inflows for manufacturing sector showed a decline between first semester of 2011 and 2012, similar situation faces real state, transport and agriculture sectors. Colombia government should be aware of this FDI decline at high added value sectors.

Economist,

e-mail: zhumber@gmail.com

Okun’s Law and the cost of high unemployment rate in Colombia

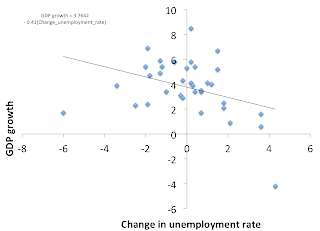

Colombia faces an structural problem in her unemployment rate. Unemployment rate has been too high since 1976, it has showed values between 7.0% and 19.9%!!!, nowadays this rate is around 9.7%. Through this information arises a natural question: what is the cost of high unemployment rate?. To answer this question it is fair to use the Okun’s Law, this economic Law points out the relation between Gross Domestic Product (GDP) growth and change in unemployment rate. Through this Law, Colombia shows the following relation:

- If unemployment does not show any change, then Colombia GDP will growth about 3.76%,

- If unemployment rate declines about 1%, then Colombia GDP will face a growth about 4.2%,

- If unemployment rate increases about 1%, then Colombia GDP will growth about 3.4% as figure 1 shows.

Figure 1. Okun’s Law* in Colombia 1977 - 2011

(annual data %)

Source: Bureau of Statistics Colombia and own calculations.

Therefore, the answer to this questions is a highly sensitive relation between change in unemployment rate with GDP growth. Therefore, Colombia government faces a big issue, her target should be to keep growing Colombia’s GDP above 3.76% if government wants to reduce the unemployment rate, the other way around unemployment issue will be worst.

The Foreign Direct Investment in Colombia: first semester of 2012

Foreign Direct Investment in Colombia is registered in the Balance of Payments (BoP) as International Monetary Found (IMF) suggest, there are other accounting sheets where FDI is resisted but they do not cover the whole of transactions. Last week Colombia Central Bank broadcast the BoP’s data for the first semester of 2012. Unfortunately FDI in Colombia is led by crude oil and coal investments with a share of 61.2% of total FDI in the first semester of 2012. Other sectors shared with 38.8% where financial sector shared with 10.4%. The added value sectors showed a low share, for instance manufacturing showed a 4.3% of total FDI in this first semester.

In terms of growth rates, the FDI in Colombia showed an increase of 18.3% if one compares first semester of 2011 with first semester of 2012 as table 1 shows. Crude oil and coal inflows contributed with 8.49% while the other sectors contributed with 9.78%. Unfortunately there was a decline growth in manufacturing, transport and agriculture sectors. This decline in FDI growth at main added value sectors should take the attention of government to change their trend.

Foreign Direct Investment inflows first semester of 2011 and 2011

(US$ million)

First semester

| |||

Sector

|

2011

|

2012

|

Growth (%)

|

Total

|

6,593.5

|

7,797.7

|

18.3

|

Crude oil sector

|

2,923.1

|

3,357.7

|

6.6

|

Mines and Quarries (including coal)

|

1,292.9

|

1,417.9

|

1.9

|

Other sectors

|

2,377.4

|

3,022.1

|

9.8

|

Financial Institutions

|

-13.7

|

682.1

|

10.6

|

Electricity, gas and water

|

245.3

|

451.9

|

3.1

|

Trade, Restaurants and Hotels

|

609.1

|

810.9

|

3.1

|

Community Services

|

-76.5

|

-11.7

|

1.0

|

Agriculture, Hunting, Forestry and Fishing

|

84.0

|

71.6

|

-0.2

|

Manufacturing

|

387.5

|

336.8

|

-0.8

|

Real state

|

230.6

|

61.9

|

-2.6

|

Transport, Storage and Communications

|

911.1

|

618.7

|

-4.4

|

No comments:

Post a Comment