Colombia government through Ecopetrol utilities distribution try cheat us, this note shows who owns Ecopetrol shares, they are people from upper class, middle class and her managers, they are no more of 5 million out of 45 million of people in Colombia, instead government must start to work in a real social solution such as as job centers in each city, new enterprises with collaboration from universities, real infrastructure such as long run metro service and so. Through statistics, government is taking profits and royalties to their private benefit, for instance financial speculation as was broadcast through media, less royalties per barrel as was showed last weekly note, lack of public information about royalties balance (where is this saving?, in Colombia or abroad?, who knows?), moreover Ecopetrol has taken a cutting job positions behavior since 1992 when there was 10,413 places, there are now just 6,744 places and finally this greedy private interest was expressed through not support to José Antonio Ocampo as candidate to World Bank president position, do not worry Mr Ocampo, lot of Colombians who care about our future and social welfare support you in this process, instead of few people who for lack of information about who really are colombians, we know you are one of the best economist around world, you have our support, best wishes.

Autor: Humberto Bernal,

Economista,

it can be download in PDF format:

Colombia is called by international media the petroleum star due to lots of petroleum companies are coming to extract this natural resource, by 2011 there were 51 firms and they are still working, most of them come from abroad, they are from Brazil, Canada, China, India, the United Kingdom, the United States, Venezuela and others countries, these companies are getting high profits, according with National Bureau of Statistics for firms (Superintendencia de Sociedades), in the last eleven years most of these firms showed profits of 21% (net utilities divided into total income). As colombian citizen I can say: “the government are doing the right thing if they think in their own private benefit, colombian petrol sector is on sale and its cost is more misery for their citizens”, this statement is sad but true, it is enough to show official statistics, table 1 shows the distribution of Ecopetrol shares, it is the biggest petroleum firm in Colombia, where poverty GINI index is about 0.56, this firm produced 34.3% of total production in 2011 and she was on the 445th place out of 500 most valuable firms around the world according to Fortune magazine in 2011, it is important to highlight from this table that 89.9% "belongs to" all colombians and the other 10.1% was divided into a “fair distribution between citizens” according to government but its is not true, one can see that this 10,1% is divided into pension found for those who has a formal job (moreover people who going to enjoy these resources are those who has a permanent job, much less people), it is right but the idea of a democratic society where everybody enjoy this system is plenty welfare, the reality, that government do not meet, is the majority do not have a stable job and the only thing we can do, unfortunately, it is watching how government divided our main resource into those who already got a well standard of life, moreover government wants to share 10% more of Ecopetrol between same people, what wrong the idea of democratic society has this government.

Table 1. Ecopetrol Owners an its value 2010

Holders

|

Percentage (%)

|

Share

(number of)

|

Money share value

(US$billion)

|

Value in financial statements (balance sheet) 2010

(US$billion)

|

State

|

89.9

|

36,384,788,817

|

78.6

|

|

Pension found

|

4.47

|

1,810,499,700

|

3.9

|

|

Natural person

|

3.71

|

1,501,050,593

|

3.2

|

|

Abroad founds and firms

|

0.25

|

99,541,909

|

0.2

|

|

Legal person

|

1.04

|

420,761,489

|

0.9

|

|

ECP-ADR founds (international founds)

|

0.63

|

255,870,080

|

0.6

|

|

Total

|

100.0

|

40,472,512,588

|

87.8

|

34.3

|

Source: Ecopetrol and Colombian stock market.

My complaint is based on official figures from 2012: 12.7 million of colombians who make known their disagreement on their employment status and 2.7 million in unemployment status. The ironic situation is government broadcast that Ecopetrol 2011 profits will be divided into shareholders as a fair distribution of income, table 1 shows this bizarre fact, the few winers are colombians who are in a fair socioeconomic status including the managers of Ecopetrol who own shares (Joaquín Moreno Uribe 50,000 shares and Mauricio Cardenas Santamaría 2,000. Source: Ecopetrol.), It is right that they own shares, they can but what about the other 40 million of people?.

Ecopetrol as enterprise that looks for high profits are cutting job positions as it is show in table 2. Due to high cost and inefficient labor productivity, Ecopetrol are cutting jobs from 10,413 job position on 1992 to 6,744 position on 2010, form economic efficient view, it is right, but government must have an employment system that take these people into economic activity again but this system is just a dream, there is a Job government department (Ministerio del Trabajo) but there is no results yet, moreover it looks like a political job employment for those who already have a fair welfare and just want passing time.

Table 2. Size of Ecopetrol employment

1992-2010

Year

|

Permanent employment (number of*)

|

Temporal employment (number of)

|

Total employment (number of)

|

|

Year

|

Permanent employment (number of)

|

Temporal (number of)

|

Total (number of)

|

1992

|

1,505

|

8,908

|

10,413

|

|

2002

|

1,072

|

6,450

|

7,522

|

1993

|

1,405

|

8,737

|

10,142

|

|

2003

|

1,152

|

5,568

|

6,720

|

1994

|

1,427

|

8,684

|

10,111

|

|

2004

|

|

|

6,027

|

1995

|

1,524

|

8,696

|

10,220

|

|

2005

|

|

|

6,063

|

1996

|

1,581

|

8,424

|

10,005

|

|

2006

|

|

|

5,816

|

1997

|

1,681

|

8,25

|

9,931

|

|

2007

|

|

|

5,887

|

1998

|

1,346

|

7,975

|

9,321

|

|

2008

|

1,324

|

5,253

|

6,577

|

1999

|

972

|

7,427

|

8,399

|

|

2009

|

|

|

6,695

|

2000

|

1,071

|

6,555

|

7,626

|

|

2010

|

|

|

6,744

|

Source: Ecopetrol and Colombian stock market.

A bizarre petroleum sector.

As was pointed out above, Ecopetrol is cutting jobs but this firm is not the only one, if one see figure 1, one realize that labor income is just 7.3% of total Petroleum Gross Domestic Product in 2009 when it used to be 29.2% in 1970, a fair argument will point that this sector is intensive in capital and technology gave them a better use of resources, it looks reasonable but the wrong thing is that the social compromise is divided just into wealthier people through high valued contracts and royalties managed under high risk scenarios for those who do not care and those who just look for private benefits, the right behavior is dealt this economic sources under social criteria.

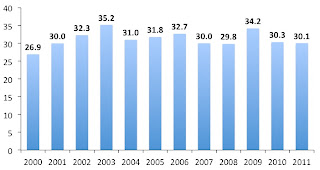

Figure 1. Labor remuneration in petrol sector as percentage of its GDP

1992-2010

(%)

Source: Bureau os statistics Colombia (DANE).

What society is expected.

First: a real system to create jobs through job offices centers where the main target of workers is to find jobs to those who do not have, these offices must be at main cities and their number according with population, moreover everybody must have the right to get this service. Royalties from petroleum and mining sector can support these offices.

Second: Projects development through universities that are on rule, it means universities that have all its document update, they have to create firms with their students and these projects must be supported through royalties form petroleum and mining sector. It is important to highlight that these economic resources are for ALL universities that are on rule, it means not just for those that government has politic interest.

Third: Infrastructure must be replaced if it is old and created if it is needed to bring development. For instance, there is a political issue about Metro line construction in Bogotá and other cities, government should not do take us as fools, the Metro line must be built thinking in the future, if government think in short run plan, citizens will pay the cost in the long run, it means a packed system, the point is people want a big comfortable Metro as Washington or London lines, the financial support come from royalties.

These are just three ideas, there are more on topics such as sustainable financial parks for everybody where people can enjoy the weekend, cities cleaner (not rubbish-trash) with a efficient well payed jobs and so. My main concern is that government does not waste royalty sources, if there are no ideas to improve social welfare, please, do not speculate or take them for private benefits, just keep them in a saving account that future generations could be find a real social spending.

By the way, although I do not get an official invitation to Summits of the Americas meeting, as wealthier people has, coming up this week, I try to write a popular agenda through this media.

In addition, if government do not give support to our best citizens due to greedy private ambitions, I do as other people broadcast by the media last week, my best wishes to José Antonio Ocampo applicant for World Bank president job.