When Colombians learned to produce crude oil in 1951, they decided to do it through government firm Ecopetrol and new types of contracts where foreign firms were welcome also. Through last half of XX century and the first years of XXI century, Colombia has changed her economic model to extract crude oil. These changes worked, but the terrorism, public corruption in royalties management and lack of discoveries have pushed down the crude oil sector. Nowadays, Colombia has crude oil reserves for next 6 years and in the best of the cases for next 10 years. These facts can be taken as the sunset of crude oil production in Colombia.

Author: Humberto Bernal,

Economist,

e-mail: zhumber@gmail.com

Twitter: Humberto_Bernal

After 1951 Colombia government decided to change the type of economic model for producing crude oil, but the result was negative in crude oil production. These changes started with government participation in crude oil production in De Mares concession through government firm Ecopetrol; moreover, the type of crude oil contract changed from concession to association in 1969; it means that government took part in all crude oil production that were run by foreign firms or local private firms. However, because of Colombia faced Balance of Payment crisis at the beginning of 50’s, local authorities decided to take control of exchange of rate in order to get foreign currencies to sort out this crisis and government regulated the crude oil price in favour of getting public revenues; therefore, foreign firms decided to reduce the FDI in crude oil sector in Colombia; between 1958 and 1976 the outflows of FDI in crude oil sector in Colombia reached US$32 million (US$273.2 million in 2012 prices); moreover, the low price of crude oil before 1973 contributed to these outflows of FDI from Colombia.

Figure 1. International crude oil price

(WTI, US$ in prices of 2012)

Source: Historical Data British Petroleum.

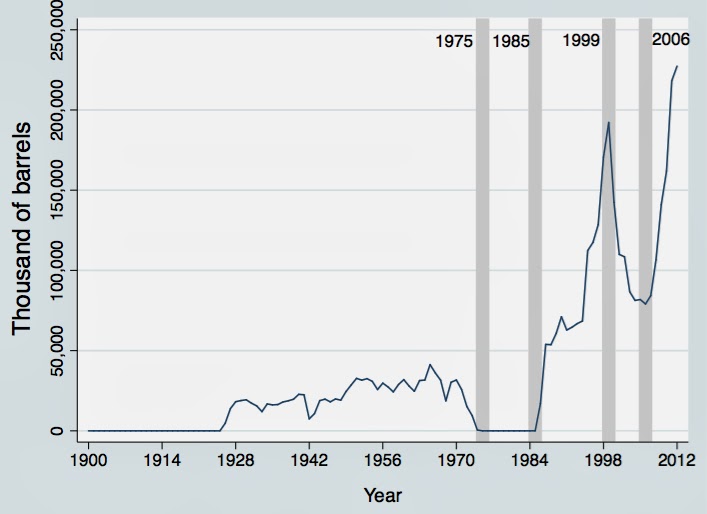

The low FDI in crude oil sector that brought a high reduction in crude oil reserves between 1951 and 1976 pushed government to make deep changes in crude oil sector. The crude oil reserves in Colombia went from 1,196 million of barrels in 1951 to 472 million of barrels in 1976; this high reduction in reserves let government to change the policy of exchange rate from regulated to free, and trading the crude oil barrel according to international prices. Moreover, the volume of crude oil exported by Colombia was null between 1975 and 1985, so Colombia missed important revenues when crude oil price was high.

Figure 2. Crude oil exports fro Colombia

(Annual thousands of crude oil barrels)

Source: Central Bank of Colombia.

Because of policy changes in crude oil sector at the end of 70’s, the FDI into crude oil sector in Colombia increased and let improving crude oil reserves. After government changed the crude oil economic policies, the FDI into crude oil sector went from negative values (outflows) to an average of US$364 million per year between 1977 to 1998 (US$513 million of 2012). Between these years there were important discoveries such as Caño Limón Coveñas well in 1983, Cusiana well in 1989 and Cupiagua well in 1993; therefore, the crude oil reserves increased from 472 million of barrels in 1976 to 3,138 in 1994, and Colombia exported crude oil again.

After 1993 there were few discoveries that contributed marginally in increasing crude oil reserves in Colombia; it can be explained by high terrorism in Colombia and unfair contracts between government and foreign firms to produce crude oil. Although Colombia got important inflows of FDI between 1993 and 2003, the number of discoveries of crude oil wells were minimum; they were Volcanera y Pauto, Guando and Gibraltar wells. Terrorism in Colombia stared to blow up pipelines; for instance, the number of terrorist attacks (pipelines blown up) went from 65 in 1993 to 261 in 2001; these terrorism attacks could be explained because of society did not get social benefits from royalties from crude oil extraction; it means that royalties management has faced high corruption. Moreover, during 90’s Colombian government changed the taxes system for crude oil firms, and it was disappointed for international firms along the low international price.

The last period of crude oil in Colombia started at the end of 2003, and it can be taken as the sunset of crude oil production in Colombia. Crude oil production in Colombia tried to take off through a new type of contracts under concession type where government firm Ecopetrol was in the list to bid for crude oil areas; moreover security environment improved along better international prices. These facts let increasing the FDI into this sector in Colombia to reach an annual inflow of US$5,377 million in 2012. The foreign firms interested in Colombian crude oil are from the United States, the United Kingdom, Canada, China and India. However, the discoveries such as Rubiales, Pirí, Quifa, Sabanero and Akacías increased the crude oil reserves marginally; nowadays, the crude oil reserves are about 2,410 million of barrels and society faces high corruption in royalties management.

No comments:

Post a Comment